US Bank Cash+ Visa Signature Credit Card Review

2022.2 Update: There’s a new benefit: earn 5% cashback on prepaid air, hotel and car reservations booked directly in the US Bank Rewards Travel Center. This is in addition to the 5% categories every quarter. HT: DoC.

2021.9 Update: The new offer is $200.

2021.1 Update: According to an email sent from US Bank, effective February 19, 2021, the following changes wlll also be made to your U.S. Bank Cash+ Visa Signature Card:

- Cash rewards will expire at the end of the calendar month 36 months after the billing cycle in which they were earned.

- Automatic monthly cash rewards redemptions will be discontinued.

- The one-time $25 Cash+ Bonus for redemptions of $100 or more will be discontinued.

- The minimum redemption required to redeem for a U.S. Bank Visa Rewards Card increases from $20 to $25 (If you use the to-be-added real time rewards feature to redeem then the minimum amount is $10).

Contents

Application Link

Benefits

- $200 offer: earn $200 cash back after spending $1,000 within the first 120 days.

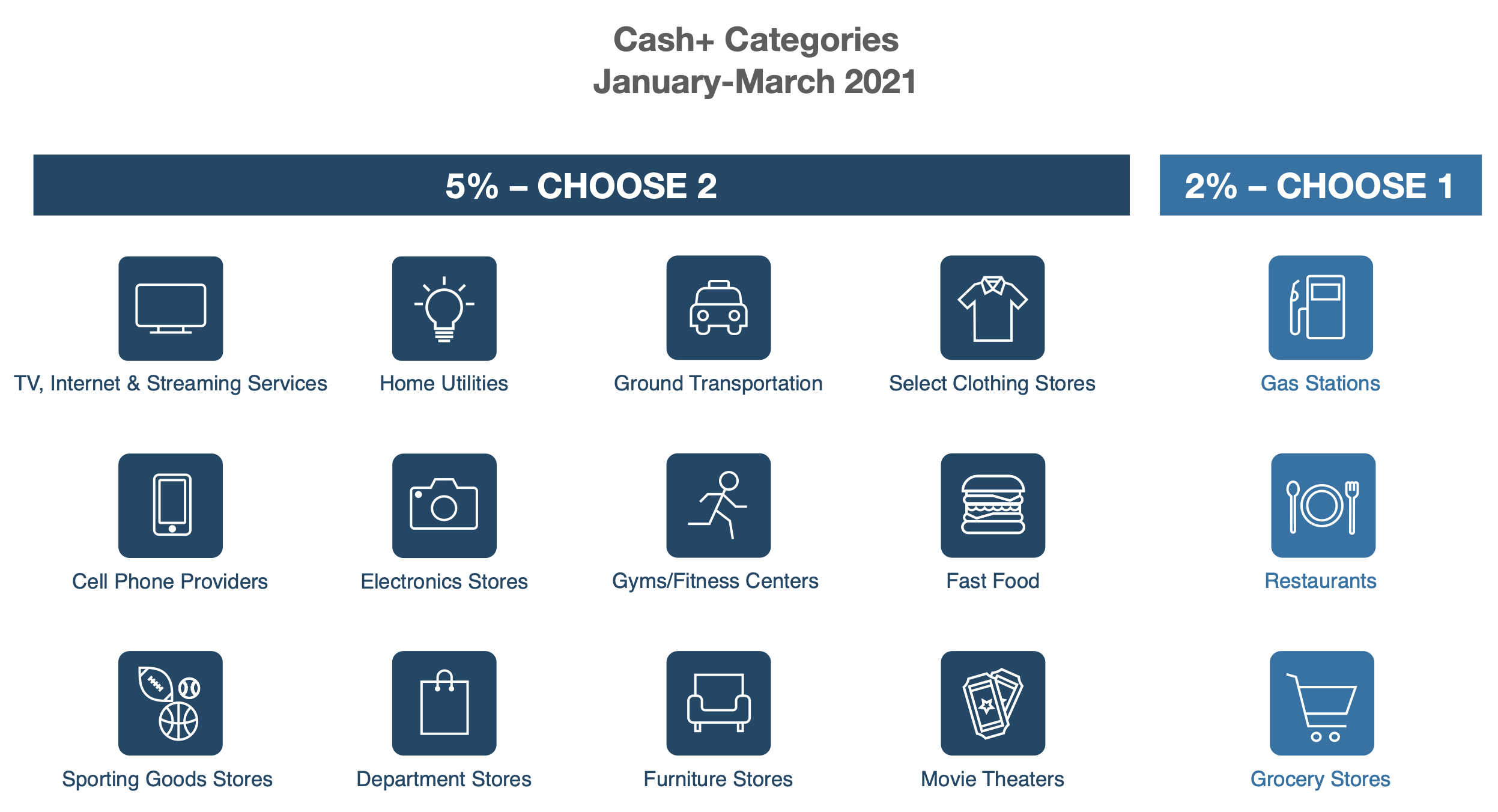

- Earn 5% cash back on first $2,000 combined purchases each quarter on two categories you choose, 2% cash back on your choice of one everyday category, 1% cash back on all other purchases. The categories are:

- [New] Earn 5% cashback on prepaid air, hotel and car reservations booked directly in the US Bank Rewards Travel Center. This is in addition to the 5% categories every quarter.

- No annual fee.

Disadvantages

- Only first $2,000 purchases per quarter on bonus categories can earn 5% cash back, after that you can only earn 1% cash back.

- [New] Starting from 2021.2.19, cash rewards will expire at the end of the calendar month 36 months after the billing cycle in which they were earned. Automatic monthly cash rewards redemption feature is discontinued. The minimum redemption amount is $25 (If you use the real time rewards feature to redeem then the minimum amount is $10).

- Note that you need to activate the 5% category every quarter (unlike BoA Cash Rewards which you still earn 3% for the previously chosen category if you forget to choose categories later on).

- Its 5% category is not as useful as those of the Chase Freedom Credit Card or Discover it Credit Card which sometimes have Restaurants, Grocery, Online Shopping, etc. as their 5% bonus category.

- It has foreign transaction fee, so it's not a good choice outside the US.

Recommended Application Time

- We recommend you apply for this card after you have a credit history of at least two years and you are very comfortable with the credit card game.

Summary

The 5% cash back seems to be good, but its categories are not as useful as the categories of Chase Freedom or Discover it. It’s better to calculate how much you can earn from this card before you decide to apply. After the change in 2021.2, cash rewards will expire after 36 months, therefore you have to pay attention to this card sometime to avoid losing your cashback. US Bank credit cards are very hard to get approved, so we do not recommend this card to beginners.

After Applying

- To check the application status, you can visit this webpage or call (800) 947-1444. If you see the 7-10 days message, it just means they will do a manual review and the outcome could be either approved or denied.

- US Bank reconsideration line: (800) 947-1444.