American Express (AmEx), with its great service and benefits, as well as the incredible 3x Credit Limit Increase (CLI), is a very popular credit/charge card issuer in the United States. It is recommended to keep at least one AmEx credit card or charge card. However, AmEx has changed it policy in 2014 so that one can only get the welcome offer for the same credit card/charge card once per lifetime. At the same time, AmEx typically doesn’t match welcome offers so that when you apply with an offer, you can’t get a higher one later. Thus, it is better to apply for AmEx cards when you get attracting offers since it is once per lifetime. Note that we mainly talk about personal credit/charge cards here. AmEx has different policies for business cards, which we will mention at the end of this article.

Note that, although some cards look like they are in the same series, but their welcome offers can be obtained separately. For example, the welcome offers of ED/EDP and BCE/BCP do not affect each other! For even more similar cards: regular Platinum, Ameriprise Platinum and Mersedez-Benz Platinum, you can get welcome offers from each one, too!

I want to say more here, by my own experiment, if for example you upgraded your ED to EDP and then downgraded it, and you haven’t got the welcome offer for EDP, then you are still qualified to the EDP welcome offer. I think it should be the same for other cards that can be upgraded or downgraded.

As we can see, getting a good offer is very important when applying for an AmEx card for the first time. For instance, the common offer of The Platinum Card from American Express is 60,000 Membership Rewards points (after spending $5,000 within the first 3 months), while the top offer is 100,000 MR points (after spending $5,000 within the first 3 months).

How to find best Amex welcome offers depends on two conditions as follows:

- Searching a pre-qualified offer;

- Incognito mode method.

1. Search an Pre-qualified Offer

First, AmEx is very generous to people who have never had any AmEx cards before, and it’s much easier for them to get top target offers. So how to get top target offers for your first AmEx card? The key is to be pre-qualified. In general, there are three ways to be pre-qualified:

- AmEx mail offer

- Pre-Qualified Offer on AmEx website

- CardMatch website

Disclosure: offers may not be available to all users. These offers are subject to change at anytime.

Many people should have received or at least see AmEx mail offers. Those offers are typically great, like the Platinum Card 100k MR offer. We recommend you to apply if you receive them. It is worth mentioning that when you apply online for your mail offer, you should choose “respond to a mail offer” with the RSVP code in the mail. That code is only valid to the targeted person, so you can’t use mail offers for other people.

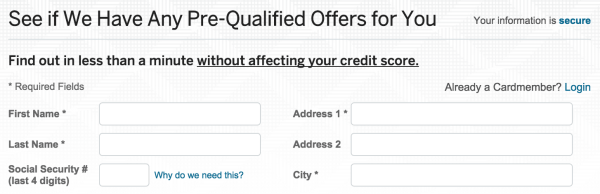

Don’t be upset if you don’t receive the mail offer since not every pre-qualified person will receive mail offer. Before applying your first AmEx card, don’t forget to check your pre-quailifed offers on AmEx website: See if We Have Any Pre-Qualified Offers for You. The page should look like below. Please use private mode or remove cookies or change browsers if you don’t see this page.

You just need to enter your personal information to check offers. There won’t be any Hard Pulls for it, and it won’t harm your credit score, either. So please check information you need as bold as you can. One of my friend checked a top offer of 100k points Platinum card in this way the day before I wrote this post.

But what if there is no offers for you on the AmEx website? You can try Card Match website to check for pre-qualified offers. It will find you pre-qualified offers not only for AmEx, but also for other banks. Thus, you can see not only Amex offers, but also other bank’s offers, such as Chase, BoA, Capital One. Amex offers are the main point we have discussed in this post and we will not talk other offers in detail. What’s more, AmEx is typically the only one that gives you pre-qualified offers better than public offers in other banks.

But what if all of these methods don’t work for me? Well in most cases that means:

- You already have or had an AmEx credit card. Then please try the second method we mentioned, which is also very useful now;

- Your credit history is not long enough. In this case, you should build your credit history. In general, many people have pre-qualified offers when they have about six months of credit history. Of course you can try to find pre-qualified offers even if your credit history is shorter than that since it doesn’t hurt anything.

- Your credit score is not high enough. You may want to check your credit report and score for free, or check the FICO score provided by Discover card first, and then try to improve your credit score. You can check scores several months later.

If you have short credit history and low credit scores, you can obtain top offers of Amex credit cards directly through the following method. But I still advise you to wait for your pre-qualified offer first. The reasons are as follows:

- You can only search the welcome offer of Platinum card through the pre-qualified offer. As the high cost of annual fees of Platinum cards, including 100k points and $550, you should consider it seriously.

- Personally speaking, the fact that you can check your pre-qualified offer seems to be a positive condition for your own personal credit scores. You’d better not hurry to apply for credit cards. It is much better for you to apply for a credit card after you have a clearing understanding of your own credit and financial conditions. And it’s wrong for you to directly apply for a credit card as you see good offers.

2. Check Incognito Mode

If you can not check your pre-qualified offers or a suitable offer among pre-qualified offers, you can obtain top offers of some certain cards for now through the following method. Previously, only some co-branded credit cards, such as Hilton, Delta and Starwood, offer higher public offers every year, and you can not obtain better welcome offers through other ways.

Now things change. Even if you have already had an Amex credit card, you can still obtain top offers of many credit cards. The reason is that Amex now likes to provide semi-public offers which can be obtained through an incognito mode of your browser or other methods. So which cards can provide such kind of semi-public offers at present?

- Premier Rewards Gold (PRG), Gold, and Green

- EveryDay (ED) and EveryDay Preferred (EDP)

- Blue Cash Everyday (BCE) and Blue Cash Preferred (BCP)

The following ways can be used for obtain such semi-public offers:

- To empty cookies in the browsers, or open links above in an incognito mode;

- Hurry up to apply for the offer as you see it! You should be noted that the same offer is also marked on the page which requires you to fill in your personal information, otherwise you may be played by Amex;

- If there is no suitable offer, you can close and reopen the link above in an incognito mode until your wanted offer occurs;

- If you cannot wait for your suitable offers, you can try the three following methods:

- to use your roommate’s computer;

- to change your place, such as your university or a coffee shop;

- to use your VPN. See VPN method.

If you still cannot obtain your suitable offer, the last method for you is to ask one who has managed to obtain such a semi-offer to help you. Certainly you must trust him because this process involves much personal information. But we advise you to adopt the last method as carefully as you can.

Many of you have paid attention to Amex Platinum card with 100k offer, which was provided temporarily in the end of August and disappeared after a short period. We have no idea about welcome offers of cards listed above about their valid periods. And we also don’t know whether they will disappear or not, and when they will become valid again. You could pay attention to credit card blogs or forums because we will update information here almost immediately after top offers come out.

In the end, let’s talk a little bit about business cards of Amex. People used to be able to get welcome offers of Amex business card more than once, but this has been put to an end since the same once per lifetime rule now also applies to business cards. However, if you manage to get a targeted mail or link without such words, we believe you should be able to sign up and catch the bonus again. Just make sure you carefully check every word in terms of condition before applying. For most cases, like personal cards, it is wise to wait for a higher public offer or targeted offer.

Appendix

Offer comparisons on Amex cards involve three options: standard offer, best offer and offer that can be checked in incognito model or not.

| Regular Offer | Best Ever Offer | Incognito Mode Offer | |

|---|---|---|---|

| Everyday (ED) | 10k | 25k | 25k |

| Everyday Preferred (EDP) | 15k | 30k | 30k |

| Blue Cash Everyday (BCE) | $100 | $250 | $250 |

| Blue Cash Preferred (BCP) | $150 | $300 | $300 |

| Cash Magnet | $150 | $250 | $250 |

| Marriott Brilliant | 75k | 100k | 75k |

| Hilton | 75k | 100k | 100k |

| Hilton Surpass | 150k | 150k | 150k |

| Hilton Aspire | 150k | 150k | 150k |

| Gold Delta Skymiles | 30k | 75k | 50k |

| Plainum Delta Skymiles | 35k | 75k | 75k |

| Green | 30k | 45k | 45k |

| Gold | 40k | 60k | 60k |

| Platinum (Regular version) | 60k | 100k | 100k |

| Platinum (Other versions) | 60k | 60k | 60k |