Apple Card Review

2024.10 Update: The $100 offer is expired. The $75 offer is still alive.

2024.8 Update: There’s $100 offer now.

2024.1 Update: The $75 offer is expired. There’s no welcome offer now.

Application Link

Features

- $75 offer: earn $75 after making one purchase in the first 30 days. The recent best offer is $100.

- Earn 3% cashback on Apple, 3% cashback on selected merchants via Apple Pay, earn 2% cashback everywhere via Apple Pay, and earn 1% cashback everywhere else. The list of 3% merchants are:

- Exxon/Mobil

- Uber & UberEATS

- Walgreen’s

- Duane Reade

- Nike

- T-Mobile store

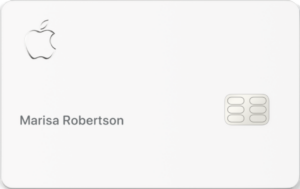

- Apply on iOS devices for the card. After that, you can request a physical card. The physical card is made by Titanium. There is no card number, no CVV, no expiration date, no signature on the physical card. If you need a card number, you can get a virtual number in the Wallet app on iOS devices.

- You only enter the last 4 digits of your SSN when you apply. Goldman Sachs is the card issuer and will give you a decision about credit limit and APR first, and then let you decide whether to continue. If you choose not to continue or get denied, there will be no hard pull (HP). There will be HP only after you continue and finish the whole process.

- No foreign transaction fee.

- No annual fee.

Disadvantages

- Sign-up bonus is low.

Summary

This is an attempt to challenge the current credit card market by Apple. It has deep integration with iOS devices. Compared to the earning structure of this card versus other cards, it is OK but not great. You can get 2% cashback in most places via Apple Pay. For the people who want to maximize credit card rewards, this card is not for you. But the card looks fancy, and maybe the Apple logo is a sufficient reason for some people to have it.